Bitcoin (BTC) rose to brand-new all-time highs on Feb. 16 adhering to a week of favorable news including Tesla accepting BTC and MicroStrategy planning to increase one more $600 million to buy Bitcoin.

BTC price breaks historical record

Data from Cointelegraph Markets and TradingView revealed BTC/USD climb over 5% in hrs on Tuesday days after BNY Mellon validated that it would certainly keep crypto Ethereum Fee Explained for possession management clients and reports also swirled around Morgan Stanley.

As soon as again after several days of sideways motion as a tussle between whales emerged, the step put Bitcoin on program to strike the mentally significant $50,000 mark.

Bulls had actually originally taken control of BTC after Tesla’s $1.5 billion Bitcoin buy-in which it revealed on Feb. 8. At the same time, the European Central Bank was amongst the cynics that declared that reserve banks as a whole would not engage with Bitcoin in future.

A lot more headaches for bears

In an upgrade, analysts at by-products system Deribit noted that the BNY Mellon information had already managed to reshape capitalist point of views.

” While BTC pulled back 10% from ATH, Feb Implied Vol pruned, suggesting gamma impacted gamers flat-long post-Tesla news,” they mentioned.

” Choices volumes exploded in Eastern hrs: Phone calls loosen up, purchasers near-OTM Puts x3k, bearish bias as BTC46k.”

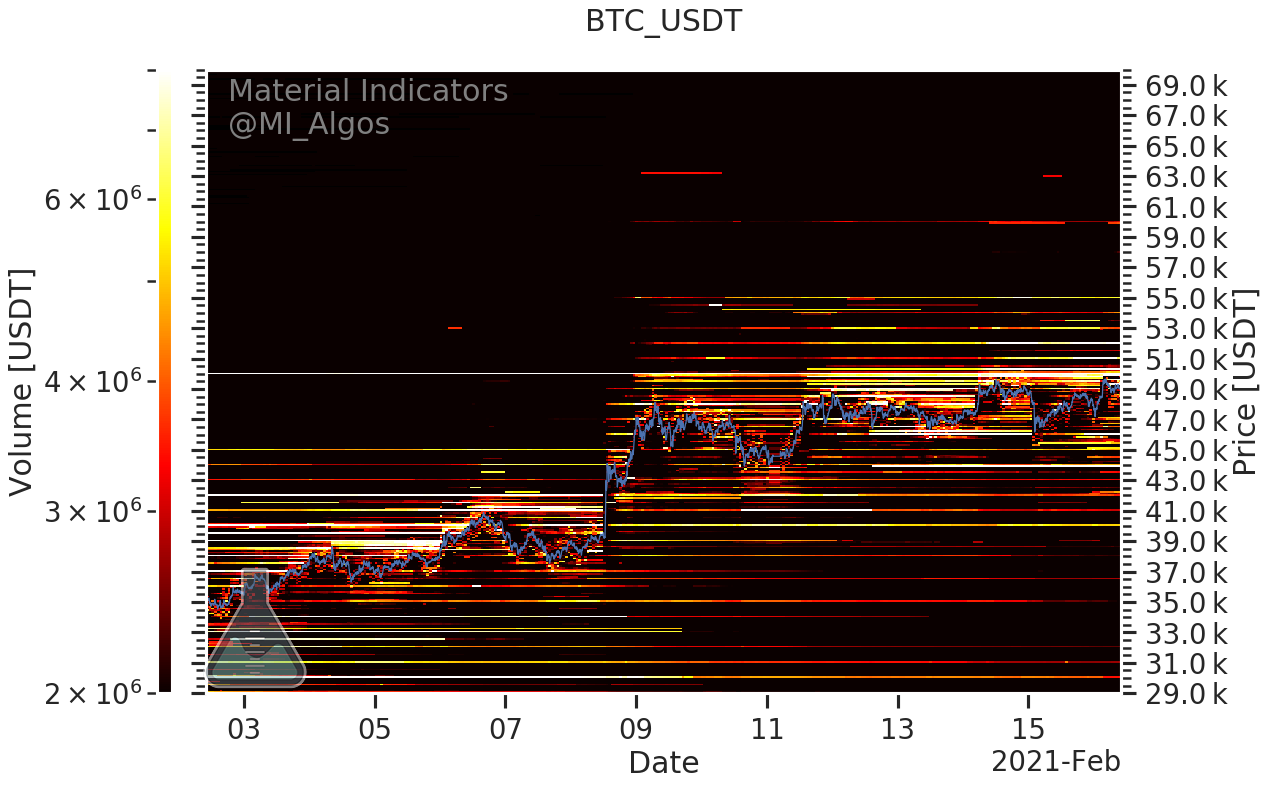

Sellers were lined up between $49,500 as well as $50,000, according to orderbook data from major exchange Binance, with enhancing support at $46,500.

Binance buy and sell settings on BTC/USD. Source: Product Indicators

In analysis this week, Cointelegraph Markets‘ Michaël van de Poppe highlighted various other elements contributing to the bull case for Bitcoin in the short term.

An inevitable accomplishment

Bitcoin had shown indicators that its general momentum would certainly not be halted throughout this month.

With Tesla and then Mastercard as drivers, market individuals were currently convinced of the stamina of its current bull run. Recently, Cointelegraph Markets contributor filbfilb provided a temporary target of $63,000 for BTC/USD, being examined by a feasible loan consolidation at around $52,000.

Tesla’s buy as well as Mastercard’s approval statement was revealed days after MicroStrategy’s committed Bitcoin for Companies summit attracted a target market of around 8,000 execs. While Tesla made setups months previously, the ramifications of the occasion were clear– firms desired as well as intended to include Bitcoin to their balance sheets.

Also previously doubtful mainstream analysts were an increasing number of in favor of Bitcoin outshining cash as a treasury asset in the long term.

” I believe it’s almost untrustworthy not to include it– every treasurer should be mosting likely to boards of directors as well as saying, ‘Should we put a small portion of our money in Bitcoin?’” CNBC host Jim Cramer said recently.

In private comments, Simon Peters, cryptoasset analyst at multi-asset financial investment platform eToro, forecast $70,000 hitting in 2021.

” While we might see temporary advantage in the price of bitcoin as well as various other cryptoassets as a result of this, Mastercard’s announcement – coming so soon after Tesla’s own comments earlier this week – has genuine long-term effects for bitcoin as well as its peers,” he said.

” Bitcoin and its peers are, fairly merely, going to belong to the mainstream economic world earlier rather than later. I expect demand to surge and also see bitcoin rates striking a minimum of $70,000 by the end of this year.”